The “Swiss-Army Knife” Business Valuation and M&A Dealmaking.

DealSense

®

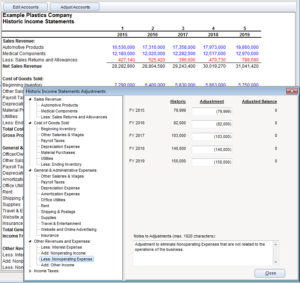

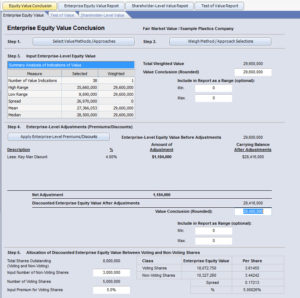

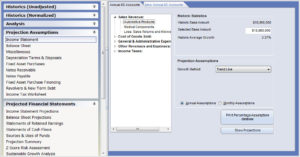

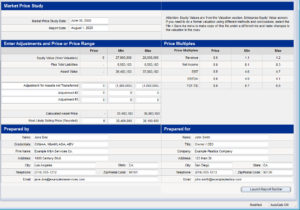

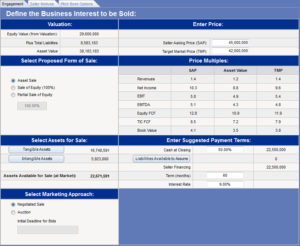

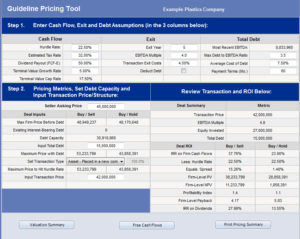

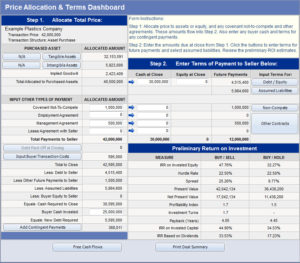

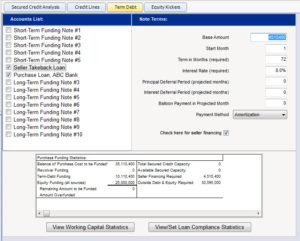

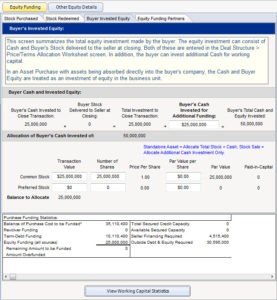

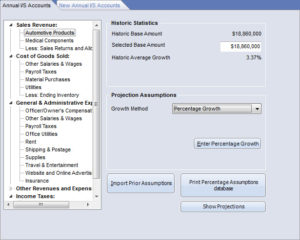

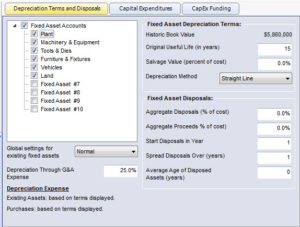

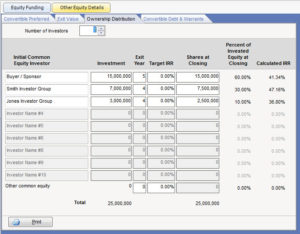

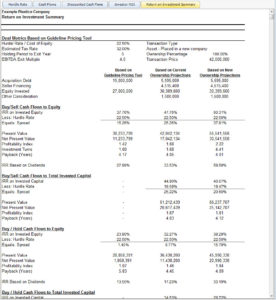

DealSense is the all-in-one system for business valuation, pricing, financing, projecting and evaluating the economics of middle-market mergers and acquisitions including combinations, consolidations and rollups. Goes well beyond business valuation to address the specific needs of business buyers, transaction advisors and accountants—on both the sell-side and buy-side.

DealSense has been aptly called the Swiss-Army Knife of Financial Analysis, Business Valuation and Merger & Acquisition planning software.

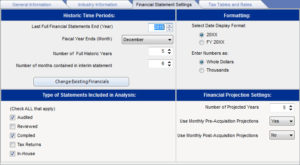

*Runs on your Windows desktop(s) or remotely from your Windows Remote Desktop Server (RDS), Terminal Server, or Citrix Server.